Introduction

In modern economic landscape, home fairness can serve as a lifeline for householders wanting rapid salary. However, you probably have terrible credits, securing a personal loan can characteristically think like an uphill warfare. Traditional lenders are usually hesitant to approve programs from americans with deficient credit ratings, and turning to brokers may not perpetually be the most desirable direction. Thankfully, there are preferences achieveable that permit you to access awful credits loans with no intermediaries. This article will book you thru the procedure of unlocking homestead equity by using securing a undesirable credit mortgage right now from creditors with no relying on agents.

Unlocking Home Equity: How to Secure a Bad Credit Loan Directly from Lenders Without Brokers

Home equity is basically the component of your house that you in reality personal, which may also be tapped into for a good number of fiscal %%!%%f53d0ff9-third-4a79-af73-7a6f2b2f8b31%%!%%. Whether it’s investment a dwelling house renovation, consolidating debt, or covering unforeseen bills, accessing this fairness can turn out priceless.

What Are Bad Credit Loans?

Bad credits loans are specifically designed for americans who have much less-than-stellar credit histories. These loans often include higher activity charges via the expanded possibility the lender assumes however can nevertheless give important budget in case you desire them so much.

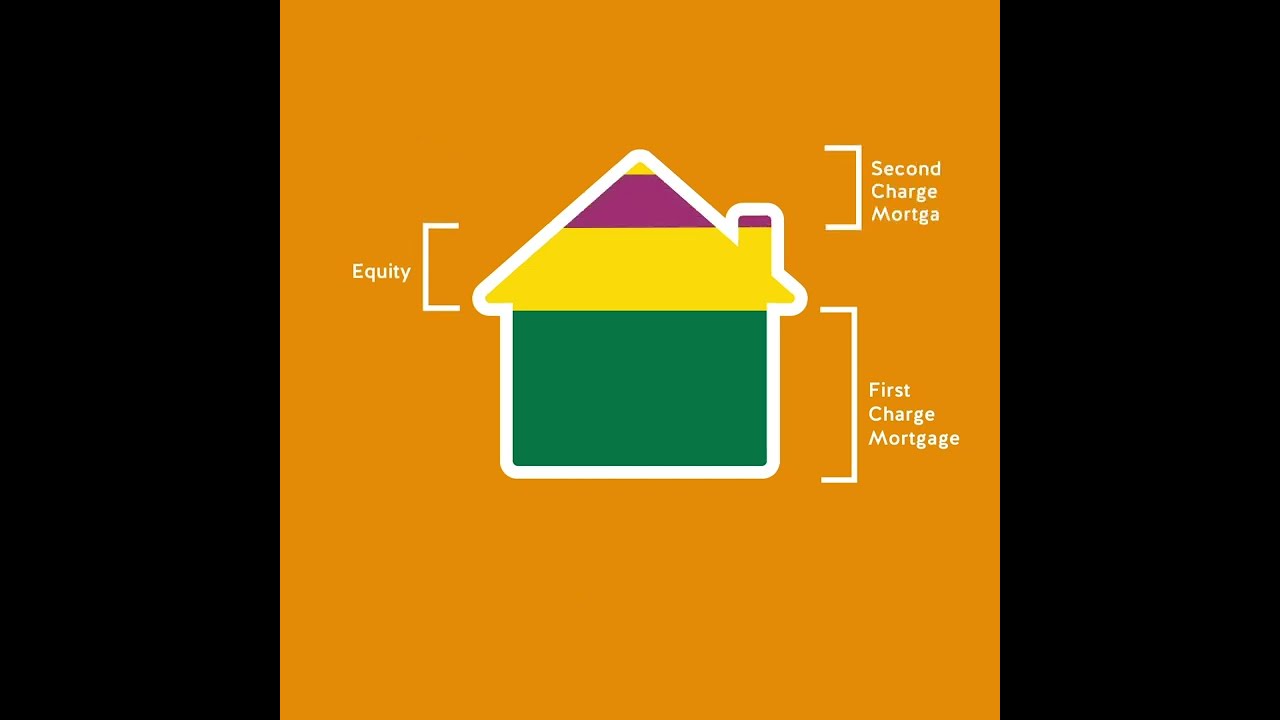

Understanding Home Equity

Home equity represents the difference between your private home's modern-day market fee and the FrequentFinance UK Office amount you owe for your mortgage. For illustration:

- Market Value of Home: $three hundred,000 Mortgage Balance: $two hundred,000 Home Equity: $a hundred,000

This fairness is usually leveraged for loans or lines of credits.

Why Choose Direct Lenders Over Brokers?

Many folks ask yourself why they should still recollect direct creditors in preference to employing agents. Here are some compelling reasons:

Lower Fees: Brokers in many instances rate bills for his or her functions. Direct Communication: By dealing right away with creditors, you can clarify phrases and conditions extra actually. Faster Approval Times: Bypassing brokers would possibly expedite the approval job. Tailored Solutions: You might also discover direct creditors greater willing to be offering custom options structured in your special fiscal subject.Navigating Bad Credit Secured Loans Instant Decision

If you are going through Frequent Finance Brokers urgent fiscal %%!%%f53d0ff9-third-4a79-af73-7a6f2b2f8b31%%!%% yet have dangerous credits, secured loans is perhaps your very best guess. These loans require collateral—generally your home—which lowers the lender's hazard and can result in faster selections.

How Do Secured Loans Work?

Secured loans feature by the use of an asset (like your house) as collateral against the personal loan volume. If you default on funds, the lender has the correct to capture the asset.

Benefits of Secured Loans

- Lower Interest Rates: Because they are subsidized by collateral. Higher Loan Amounts: You can pretty much borrow extra than unsecured loans. Improved Approval Rates: Lenders are largely extra keen to lend in opposition t secured property.

The Instant Decision Process

Many direct lenders now offer on the spot selection-making on secured loans for those with bad credit:

Application Submission: Fill out a web application detailing your fiscal difficulty. Credit Check: The lender plays a short assessment of your credit history. Collateral Evaluation: The lender assesses your asset's significance (abode). Decision Notification: In many cases, one can be aware of within mins while you're licensed.Finding Secured Loan Lenders

When shopping for secured loan creditors who cater chiefly to those with poor credit, this is major to do thorough investigation.

Tips for Finding Reputable Lenders

Online Research: Use relied on economic web content to examine special creditors' presents. Read Reviews: Customer comments can grant insight into the lender's reliability and service exceptional. Check Credentials: Verify that the lender is certified and controlled to your country.Recommended Types of Direct Lenders

- Credit Unions: Often greater flexible in lending practices. Online Banks: Many specialise in dangerous credit financing. Peer-to-Peer Lending Platforms: Connect debtors promptly with buyers willing to fund loans.

Understanding Bad Credit Direct Lender Options

As talked about previous, dealing right now with creditors allows you higher flexibility and probably larger terms for loans in spite of having horrific credits.

What Makes a Good Direct Lender?

Look out for those qualities while opting for an instantaneous lender:

Transparent Practices Competitive Interest Rates Flexible Repayment Terms Strong Customer SupportExamples of Well-Rated Direct Lenders

Here are some first rate features in which it's possible you'll locate favorable terms:

| Lender Name | Loan Type | Interest Rate Range | Special Features | |--------------------|--------------------------|---------------------|---------------------------------------| | Avant | Personal & Secured Loans | nine% - 36% | Fast funding | | OneMain Financial | Secured & Unsecured | 18% - 35% | Flexible cost thoughts | | LightStream | Secured | 2.49% - 19% | No expenses; related-day funding |

Exploring Direct Loan Bad Credit Lenders

The global of finance is brimming with ideas in case you're having a look specially for direct mortgage companies that cater to contributors with terrible credit score histories.

Pros and Cons of Using Direct Loan Providers

Pros:

- Faster processing times Potentially scale down fees More personalized service

Cons:

- Higher activity charges compared to traditional loans May require full-size collateral

FAQ Section

What different types of documentation do I desire for a secured mortgage?

You'll almost always need proof of profit, details about your house (like tax checks), and tips approximately any money owed or present mortgages.

How tons can I borrow towards my homestead fairness?

Loan amounts basically depend upon how much fairness you've gotten outfitted up in your place; mainly as much as eighty five% of your reachable fairness is likely to be borrowed.

Can I get authorised if I’ve declared financial ruin earlier?

Yes! Some direct lenders focus on working with participants who've chapter histories however expect larger pastime charges and stricter phrases.

How long does it take to get hold of payments after approval?

Typically among one commercial enterprise FrequentFinance Experts day as much as a couple of weeks depending on various factors together with forms efficiency and lender protocols.

Are there any hidden fees in these loans?

It’s very important to study thru all mortgage information completely formerly signing whatever thing; inquire approximately means charges prematurely so there aren’t any surprises later on!

Can I pay off my secured mortgage early with out consequences?

Many direct creditors allow early repayment; besides the fact that, ascertain this beforehand finalizing any contract as guidelines differ largely from one company to another.

Conclusion

Unlocking house fairness by means of dangerous credit loans straight away from lenders with out agents is absolutely available whenever you equip yourself with competencies and workout endurance throughout the time of the job. Recognizing that there are dissimilar avenues achievable enables demystify what once gave the impression daunting—allowing property owners like your self get entry to now not simply payments however additionally peace of brain throughout demanding occasions ahead! Always bear in mind that even though navigating this adventure may possibly consider intimidating before everything glance—the true substances exist at every turn ready simply under the floor!

By following this finished publication filled with actionable insights into securing terrible credits home owner loans along simple details involving dependable borrowing practices—you might be neatly positioned in opposition to unlocking both chances within your private funds although keeping regulate over destiny payments as good!